The Net Promoter ScoreSM (NPS®) is a simple but powerful tool to measure client satisfaction with one single question, an indication of the growth potential of your company or product. Read further for an overview on the use, application and pitfalls of NPS.

What is the Net Promoter Score?

The Net Promoter Score is a customer loyalty metric developed in 2003 by management consultant Fred Reichheld of Bain & Company in collaboration with the company Satmetrix. The objective was to determine a clear and easily interpretable customer satisfaction score which can be compared over time or between different industries.

The NPS assesses to what extent a respondent would recommend a certain company, product or service to his friends, relatives or colleagues. The idea is simple: if you like using a certain product or doing business with a particular company, you like to share this experience with others. Specifically, the respondent is asked the following “ultimate” question:

How likely are you to recommend company/brand/product X

to a friend/colleague/relative?

This can be answered on an 11-point rating scale, ranging from 0 (not at all likely) to 10 (extremely likely).

Calculation

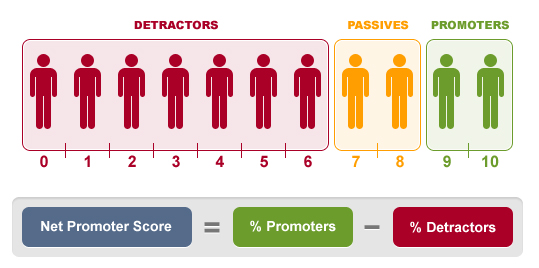

Depending on the score that is given to the Net Promoter question, three categories of people can be distinguished:

- Promoters = respondents giving a 9 or 10 score

- Passives = respondents giving a 7 or 8 score

- Detractors = respondents giving a 0 to 6 score

The Net Promoter Score is calculated as the difference between the percentage of Promoters and Detractors. The NPS is not expressed as a percentage but as an absolute number lying between -100 and +100.

For instance, if you have 25% Promoters, 55% Passives and 20% Detractors, the NPS will be +5. A positive NPS (>0) is generally considered as good.

Don’t make the common mistake of placing a percent sign (%) behind your NPS score, it is not a percentage.

What’s the average Net Promoter Score?

Nowadays, NPS is used by many large companies as a customer feedback tool. It gives your organization an unambiguous number that is easy to understand for all employees and useful as input for managers to steer the company. According to many people the NPS also gives a good indication of growth potential and customer loyalty for a company or product. You can track the evolution of the NPS over time, or compare it with a predetermined target. You can also benchmark different areas or products, or check where your company positions itself versus the industry average if this is available.

To give an indication: according to Reichheld the average American company scores less than +10 on the NPS, while the highest performing organizations are situated between +50 and +80. These values may however vary considerably from sector to sector and from culture to culture.

To understand the motives of Promoters and Detractors it is recommended to accompany the NPS question by one or more open questions that probe the underlying reasons behind the given score. This allows you to make the appropriate adjustments to increase the future NPS, either by boosting the percentage of Promoters, either by reducing the proportion of Passives and Detractors (or better yet, a combination of both).

NPS in the CheckMarket tool

To respond to the increasing popularity of the Net Promoter Score CheckMarket has decided to add the NPS question as standard question in the tool. If you want to use the NPS in your survey, the only thing you have to do is to select this question type. It is still possible to modify the formulation of the question or the naming of the endpoint value labels.

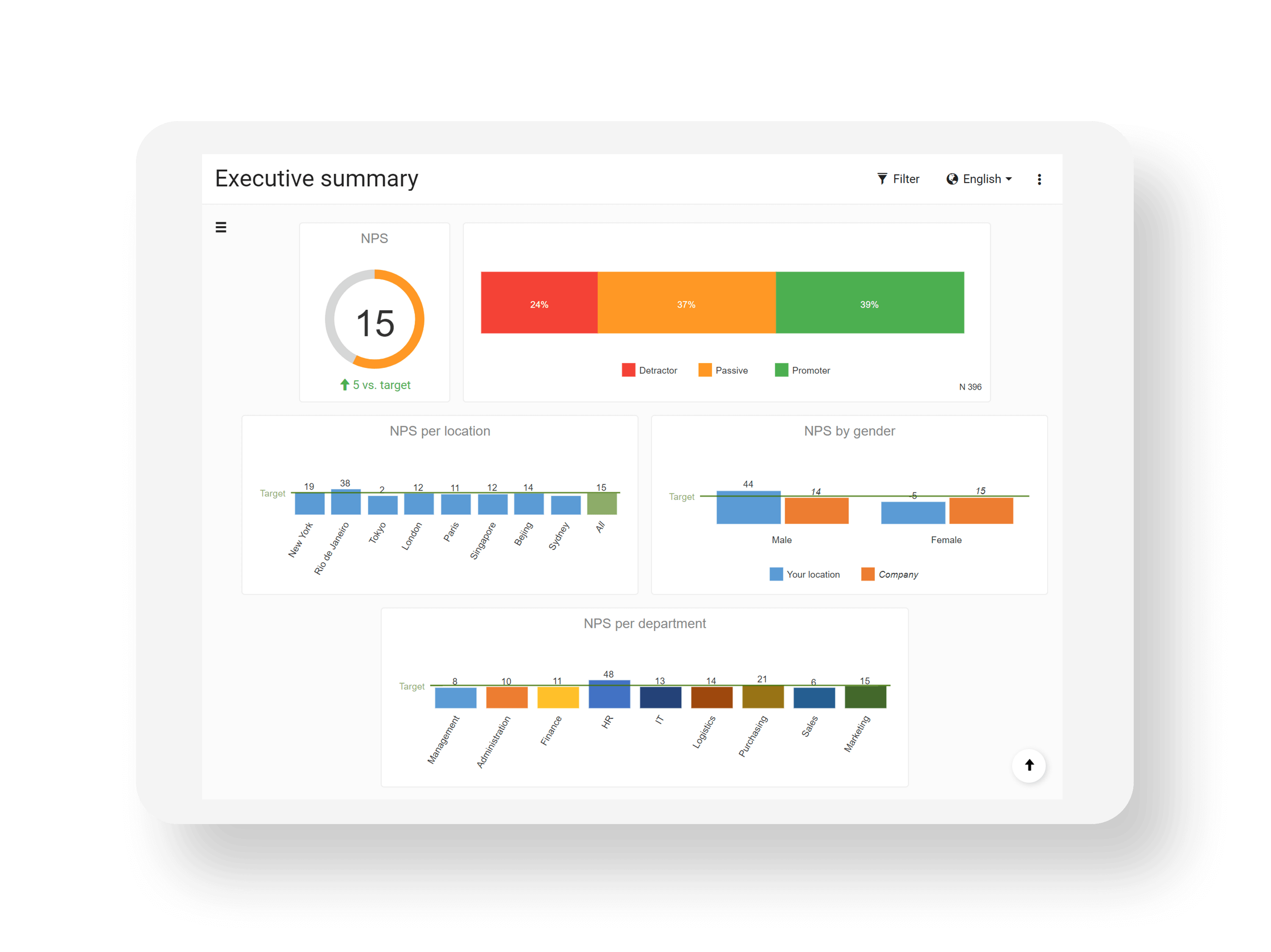

Once the responses start rolling in, you will see a bar chart in the reporting tool, showing the percentage of Detractors (red), Passives (orange) and Promoters (green). Under that is the detailed response distribution for the 11 possible scores. Based on these percentages, the actual NPS is calculated. Your NPS is represented on an easy-to-read gauge (showing positive NPS in green, negative in red). Enabling you to see at a glance how well your product or business is performing.

Some critical remarks

From a scientific perspective and in certain market research circles there is some skepticism about the NPS. Opponents of the NPS concept argue that there is insufficient scientific base for the outcome and that the model is too simple. They claim customer loyalty and satisfaction is not only about numbers and percentages, but also about causes, consequences and correlations.

It is also suggested that the NPS method cannot accurately measure customer behavior. Customers can claim they will recommend a company or product in a greater or lesser extent, but it is not proven they will actually do that in practice. Besides that, the recommendation of one customer is not always as valuable as that of another one. It is also a fact that the NPS is more useful in markets with a lot of competition where potential buyers have a greater tendency to ask friends or acquaintances for advice before deciding about a purchase. Another limitation of NPS is that it only takes into account customers, while also a lot of non-customers can act as detractors and generate bad word-of-mouth publicity.

Furthermore the NPS disregards important differences in the answer score distribution: no distinction is made between a 0 score and a 6 score, while there is obviously a substantial discrepancy between those two. It also makes no difference whether there are 70% Promoters and 30% Detractors or 40% Promoters and 0% Detractors. Both result in an NPS of +40 which doesn’t seem very logical.

Conclusion

Some caution is therefore required. It is obvious that the NPS on its own may not be sufficient as a management tool, but in the right framework and with some additional motivational questioning it can undoubtedly be a useful metric. Its greatest strength is the simplicity, making it functional and interpretable for every stakeholder. Considering the large number of big companies using this tool on a continuous basis, it certainly has proven its worth.

To be clear, NPS is only a starting point. After the analysis, the real work can begin: improving your organization and taking actions to boost your NPS. This will be a long term project, but the NPS allows you to perfectly assess at which stage your organization is in this growth process.

Net Promoter and NPS are registered service marks, and Net Promoter Score and Net Promoter System are service marks, of Bain & Company, Inc., Satmetrix Systems, Inc. and Fred Reichheld

More on Net Promotor Score?

- Net Promoter Score Software

- Watch the recording of our Net Promoter Score webinars:

NPS – Advanced Workflow

NPS – Get everybody involved - NPS clearly explained in 14 slides (Slideshare)

- Look at sample NPS survey results

(Password to access results: NPScore) - Use our NPS Calculator

- How to turn NPS passives into promoters

- How to turn NPS detractors into promoters

252 comments

Join the conversationAudintel - December, 2021

Great analysis on net promoter score. Thanks for sharing….

Supplier management - March, 2021

The article is very informative which is worth reading it . Thanks for sharing

Ferdie - January, 2021

Hi There. Is there anyone out there that knows the calculation to put in an excel/google sheet that can calculate how many promoters are needed to get to a certain goal. I know I can just keep guessing until I get it right, but there has got to be a formula that I can plug in to the sheet that will do it for me. I know the calculation on how to get the score, but I need the calculation on how to get a target number. The tricky part I am running into is that the NPS total score changes due to the total number of surveys and any detractor or neutral will effect that. Any help is appreciated. Thanks!

Melinda Johns - December, 2020

I’ve been researching this topic lately and found your easy to read and understand article! Thank you for putting it together! It does keep bringing value to its readers even in 2020! Another question I had on this topic was “When is is the right time to send NPS survey”, the answer to which I happened to find in this blog post https://blog.coupler.io/net-promoter-score-calculation/ So I highly recommended it as well!

Ben Arrowsmith - November, 2020

Hi, I am currently analyzing our NPS scores as a whole and comparing them to the scores across individual products. When I take the overall NPS score, it is different to the average of the NPS scores across the different products. I assume this is due to having fewer responses for some products which has therefore created a skewed NPS in some instances, is this correct?

I also assume therefore that the overall NPS is still the more accurate result but the individual scores are not necessarily ‘incorrect’ either?

Gert Van Dessel - December, 2020

Hi Ben,

Sorry for the late reply.

You are correct, you cannot take an average of the individuel NPS scores per product to get the global NPS, you have to take the weighted average based on the number of respondents per product.

Nevertheless, your global NPS and individual NPS scores as such will be correct.

Simon - January, 2021

Hi, This is a great blog – wish I had found it earlier! We have started to ask for an NPS score in our quarterly customer survey. Having read your blog we are not getting enough responses for it to be of an acceptable accuracy level (typically we are getting 50-75 responses per country per qtr). I have purposely kept away from combining the scores of different countries across Europe due to the cultural differences. I don’t want to reduce the frequency of surveys as it is great to have a regular pulse on progress and I have also tried many different ways to increase our responses rates but getting to 150+ doesn’t seem realistic. What would you recommend as the best way forward? For example combining with previous Qtr scores to get a rolling average? Is this feasible? Any other ideas / recommendations? Thanks in advance

Gert Van Dessel - January, 2021

Hi Simon,

If youir response rate is not sufficient to compare quartterly results, you can compare semesters or, if you want a quarterly update us a rolling average as you suggest.

You can track a quarterly global NPS score to detect general trends, but, as you state correctly, due to the cultural differences, in the end you will have to go in detail to investigate evolutions per country.

Matt - January, 2020

Hello, my team has just piloted an NPS survey for our employees who use our internal IT department. Basically, anytime they put in a ticket we send them an NPS survey (along with a few other questions). After reviewing some initial feedback, some respondents are echoing my thoughts about the contradictory nature in asking to “recommend” the internal IT department to a fellow coworker because there is no other choice in the matter (e.g., if you need to get your password reset, you HAVE to contact us). Thus, a respondent could put a 10 for “recommend”, while their satisfaction with the experience was a 0 (and this was an actual comment we received).

So, is an NPS question still viable in this type of “customer” and “company” relationship? Is there any sort of word-smithing that could make the question more logical while still retaining the purpose of an NPS question (e.g., “How likely are you to recommend to a colleague that you had a positive experience with IT for this ticket?”)? Or would it be better to use a more straight forward satisfaction question?

At the end of the day, I know we’ll still received lots of great feedback and be able to make changes for better experiences, but I can’t help but wonder if we would receive better feedback and a more meaningful score with a more logical question.

Thanks in advance!

Alexander Dobronte - February, 2020

Great question, Matt! NPS is popular because of its simplicity. It is sometimes like having a hammer, all of a sudden, everything looks like a nail. We agree that NPS is not the right question to be asking here. Since employees have no choice,’recommending’ a ‘different IT department’ is not an option;) A question we like to use in this case, would be a Customer Effort Score (CES). “IT support made it easy to handle my issue” (7 point scale). Strongly disagree to Strongly agree.

You can even go more simple, just asking if they were satisfied with the issue handling, yes or no. That lets you do triage further in the survey and follow-up and it is easy to answer for a respondent. To get the highest response rate, both questions should be embedded directly in the email notification when the ticket is closed to make it as easy to answer as possible.

We have best practice templates for NPS, CES and Post-contact surveys. So create an account and try them out. Good luck!

Ian Koxvold - September, 2019

The issue that I find most fascinating is the difference in NPS score depending on whether you ask about yourself or about someone else. I have many times multiple surveys covering the same company, where the one they ran gives them an NPS score c.40-50 points higher than the ones run by third parties.

This is pretty intuitive – it turns out that you’re more likely to say I’m a nice guy if I ask you than you are if some random person asks you.

This has a couple of implications. It’s fine if you want to look at how NPS varies by customer segment, or over time. It’s very misleading if you are comparing your NPS to your competitors (when you ran the survey).

Alexander Dobronte - September, 2019

That is good point. That phenomenon is a type of response bias called demand characteristics bias. Respondents can take on a ‘apprehensive-participant role’ and want to behave in a socially desirable way. It is one of the reasons we do not encourage our clients to use NPS benchmark data. NPS is best used as a triage mechanism to obtain details about what works and what is not working for your company or product. Find out what detractors are not liking and get that information deep into your organization to affect change. The same for what promoters like so much, also get that information deep into your organization so that it can be replicated with other customers.

greenkr1 - May, 2019

We’ve got several clients who are pushing to apply the NPS scale to non-NPS questions (they want to use it to measure all variables). Is this recommended? Are there pitfalls? It seems that the NPS scale is designed to ask a specific question – and provide a specific interpretation of the answers. Looking for some guidance on if applying it in other scenarios is recommended. Thanks!

Gert Van Dessel - May, 2019

The NPS scale is specifically designed to measure customer experience and predict business growth based on the calculated NPS score.

I would not recommend using this for other purposes. You will get a score of course, but this has no real meaning in another context.

Fraction.Calc - April, 2019

This NPS tool is very helpful in determining whether your business is growing or losing. I guess this is very important to business people and executives.

Nicholas - April, 2019

Hey there. Would love to have some support over here. I’m running a survey to calculate the NPS score for people who just bought their house at Sengkang Central Residences. We created a survey form with Surveygizmo. Right now, I have data in an Excel but I’m wondering how can I translate into a more readable format?

Gert Van Dessel - April, 2019

Hi Nicolas,

I suggest to use CheckMarket for your future surveys.

NPS uis a standard question type in our tool, and we have built-in reports where NPS score is already calculated automatically.

Allen - March, 2019

Hi, thank you for the great info.

I am working in a team that offering different services to others teams in our company.

We got some issues when we ask our customers ‘how do you recommend ‘our team’s name’ to your friend’ because our customers are just familiar with the services we are offering and have no idea of what our team is.

For example, we are running agile trainings across Technology. It is reasonable to ask them ‘how do you recommend our agile trainings to your friend’. But will make them confused if we ask ‘how do you recommend ‘our team’s name’. So in this case, how can we get the right NPS at a team level and not just for a service we are offering? Or if we can get NPS for each of the services we are offering and combine them together, is it an appropriate way to reflect on our team’s NPS? (a little bit similar to the question below)

Gert Van Dessel - April, 2019

Hi Allen,

You are correct it makes no sense to ask for a NPS score for a particular team when your customers are not familiar with the team names.

But if you know the relevant team for each of your customers, you can use this as background data, and afterwards you can filter on your results to get the NPS score per team.

When you use our survey tool to distribute your survey, you can import an Excel file with all relevant information per customer (including the name of the relevant team).

The team name per contact will be imported (together with customer name and e-mail address + other relevant info) and is available in our tool for further analysis.

Ruben - March, 2019

Hi, thanks for the information.

In my company we currently measured nps per customer touchpoint (sales, onboarding, service, etc).

What is the appropriate way to resume all local nps indicators into a single measures?

My company is in the SaaS industry.

Gert Van Dessel - March, 2019

Hi Ruben,

The methodogically correct option is to calculate your global NPS based on all underlying scores coming from your total sample.

However, if you want to allocate equal weight to each touchpoint, you can calculate the average of NPS scores for the touchpoints.

Or, if the response rate per touchpoint differs considerably, it would also be an options to calculate weighted averages based on the total population per touchpoint.

Most important is to keep the methodoloy for calculation consistent over time.

Marcella Colombino - December, 2018

Hi Gert,

I have a question regarding population.

I work in a B2B environment, in my CRM I have 2’000 companies, 10’000 customers, but only 5’000 email addresses/telefone numbers.

My population for Sample calculation should be what? The 2’000 companies, the 10’000 customers or the 5’000 usable “contacts”? Very curious about your answer.

Marcella

Gert Van Dessel - December, 2018

Hi Marcella,

This depends on the objectives of your research. If your study is on a company level (you want one response from a relevant contact person per company), then your population will be 2000.

If your object of interest are the customers themselves (you want as many answers as possible, which means multiple per company if possible, then your population will be 10000 (so not only the 5000 usable contacts).

Neeraj - April, 2019

Hello

If there are 100 promotors which achieve 25% score. How many promotors are required to achieve 30% score?

Gert Van Dessel - April, 2019

This depends on the number of passives and detractors.

Irfan Warsi - December, 2018

Hi

I can even use this process to monitor the quality/ratings of the delivery Rider. Right?

Gert Van Dessel - December, 2018

Hi Irfan,

Yes, it is perfectly possible to use the NPS score for that purpose.

John E - October, 2018

Thanku!Its so helpful article Related to NPS Your calculation is impact positively by which we can conduct more surveys

Priyesh - September, 2018

If we have number of detractors, number of neutrals and nps score. And want to get the promoters number then what will be the calculations??

Gert Van Dessel - September, 2018

Hi Priyesh,

To calculate the number of promoters (P), you start from the following equation:

NPS=(P-D)/(D+N+P)x100 with D = Nr. of Detractors and N = Nr. of Neutrals

After some calculations, you get the following formula for the number of promoters:

P=(D*NPS+N*NPS+100D)/(100-NPS)

For example, if you have 100 Detractors, 400 Neutrals and NPS = 40

P = (100*40+400*40+100*100)/(100-40) = 30000/60 = 500

Tolu - May, 2018

Dear Team

Please what happens to NPS score when you have 100% passive rating i.e no Promoters and no detractors

Gert Van Dessel - May, 2018

In that case your NPS score will be 0 (0% promoters – 0% detractors)

Mike Price - May, 2018

Gert,

Two questions. First, if a canceled customer is accidentally called, does this score stand? And second, are the circumstances, such as rudeness or mistakes that that the survey taker may make (or others), that would cause the score to be removed from the statistics? I’m told that ‘real’ surveys leave all responses in regardless of the circumstances.

Gert Van Dessel - May, 2018

Hello Mike,

Sorry for the late reply and thanks for the interesting questions.

I personally would leave anything out that could disturb the objective measurement of your NPS score.

The advantage of measuring the NPS via an online survey is that there is no influence of the interviewer.

And I would advise to try to make your respondent base large enough. This limits the impact of potential ‘mistakes’ to a absolute minimum.

hardip Davda - February, 2017

HI, Lots of information on nps, we want to know we are in online travel portal company.

what could be the best time to ask for NPS? after booking tickets? or after he travelled? because it may get negative response based on consumer experience with that travel company.

IS NPS for online site, right? so shall we ask the consumer post booking done?

Gert Van Dessel - March, 2017

Hi Davda,

This depends on which part of the process you want to evaluate. If it’s only the booking process, it’s best to ask the question directly after the (online) booking process.

If you want to evaluate the whole travel experience, you should ask after the journey.

Fredwar Sequera - December, 2016

Hey Gert!

So, I ran an NPS score on my project 3 months ago. In it I had 57 responses scoring a solid +3.5 NPS back then. We’re at the end of the semester and I ran it again, this time having 86 responses and scoring a solid 0, 23% detractors, 23% promoters and 40% passive clients. My question goes towards this “passive” clients, several of them are obvious and confirmed promoters of my project, they’ve reccommended it to friends and are spreading the word as to how our project is an experience everyone should be part of, and this people have given us a scor of 7-8 (mostly 8) So I’d like to know if there is some sort of study with which I can prove or consider 8 as a promoter and not as a passive. Keeping in mind that I’m running an NPS study on people who come from Europe, Asia, America, etc.

Gert Van Dessel - December, 2016

Fredwar,

Thanks for your comment. NPS is a standardized methodology, so for uniformity reasons and benchmarking you have to accept that clients giving a 7-8 score are considered as passives.

Of course it is possible that some of the passives will recommend you to their friends/families, but it might as well be that some of your promoters giving a 9-10 never speak to anyone about your product. Most important for your NPS follow-up is the evolution over time. Which actions can you undertake to turn your detractors into passives and passives into promoters? With a little extra effort you might change an 8 score to a 9 or 10.

Roy - October, 2016

Hi Gert. I’m curious as to what moving average to use as a reporting tool for NPS.

Do I just use the regular moving average (average over 3 months including the last one), or do I use a weighted version? And in case of a weighted moving average. How is this calculated? Because f.e. the last 3 months my scores have been -13, +6 and +1. But the respondents over those months were differently aswell, the first month (-13) had 67 responses, the second (+6) had 77 responses and the last month (+1) had 84 responses.

Should this be of any influence to the way the weighted moving average is calculated?

The only formula I’ve seen so far is (X * 0,5 + X-1 * 0,3 + X-2 * 0,2)/3. But this wouldn’t take in account that the latest month has more responses and thus is more stabilized than the months before that.

Gert Van Dessel - October, 2016

Roy,

I would use a moving average weighed by the number of respondents per month.

In your case, the formula to use would be:

(67*NPS1+77*NPS2+84*NPS3)/(67+77+84)

which gives -1.4 as a result for yuor moving average NPS

Greg - September, 2016

Hello. I was wondering if it would be in good practice to show where the promoters, passives, and detractors are in the scale when asking the question? Or would this taint the results?

Thanks.

Gert Van Dessel - September, 2016

Hi Greg,

We strongly recommend not to do this, as experience from the past shows that this results in biased (more specific – higher) NPS scores.

If you want to benchmark with other NPS scores, you need to use the standardized methodology.

Vijay - September, 2016

How to get customer recommendations for NPS when product sold through dealers/distributors?

Gert Van Dessel - September, 2016

Vijay,

If you have access to the customer database of your dealers/distributors, you can send out your NPS survey yourself the the email contacts in these databases.

The other option is that the dealers send out the survey themselves, for instance linked on a transaction (purchase or delivery of the purchased goods).

If you include the dealer info in your database, you can filter afterwards and compare results for the different dealers (easy to do in the standard reporting module in our survey tool).

Vijay - September, 2016

Thanks Gert.

Some of the consumable products have been sold by multiple levels of sub dealers, where the bottom level sub dealers don’t want to disclose their customer details or properly maintain.

(for example some branded shoes are sold by local sub distributors at multiple level in depth)

Like to know the current practice in such scenario.

Gert Van Dessel - September, 2016

Vijay,

If you don’t have contact details of your customers, you can try to distribute the survey via your company’s website or social media channels you have developed for the different brands.

Or hang out posters in the local stores with QR-codes, or put QR-codes on the purchase bill, advertising flyers, …

Barry - May, 2016

Hi Gert,

When I stay at a hotel on popular websites, they ask me “would you recommend this place to a friend – yes or no”. Often times these hotels have a 80-90% “recommendation” score (although I completely understand that everyone that answered yes is likely not a promotor).. Regardless, I want to compare NPS to be able to benchmark with these types of results. What would be an appropriate scale for this comparison (for example, anything above a 5 would be a “yes”)?

I hope this makes sense!

Gert Van Dessel - June, 2016

Barry,

Because you use two completely different scales, any comparison would be arbitrary. For me, a 6 score for a hotel would not be a recommendation to visit it.

I would look for hotels that have at least an average score of 8 or more.

Barry - June, 2016

So it would not be correct to say the upper half of the numbers on the scale would represent a “yes” and the lower half would be a “no”?

Gert Van Dessel - June, 2016

Barry,

No, it would not be correct to say that someone who gives you a score of 6 out of then would automatically recommend your hotel.

In the definition of the NPS, only the ones giving 9-10 scores are real promoters.

Lane Tapley - May, 2016

i have b2b client with 300 customers – assume this is too small a base to measure NPS, are there other metrics i could use for small base

Gert Van Dessel - May, 2016

Lane,

If you could achieve a 50% response rate (150 responses), you can already use NPS as an indication of how your client is doing. You just have to make sure to be careful with the interpretation and try to make optimal use of the wording in the comments > why would respondents (not) recommend your client?

John - May, 2016

What is the minimum number of respondents necessary for a validated NPS? In our example, we want to use NPS for the members of an athletic team, and team members can range from 8-100 depending on the sport.

Thanks!

Gert Van Dessel - May, 2016

Hi John,

To have any statistical relevance, I would go for a minimum of 100 (ideally you need 300), so probably you will have to combine different sports to get to this number.

John - May, 2016

So what if a team only has 10-30 members? Can the NPS still be used? It would be hard to combine sports with different coaches.

Gert Van Dessel - June, 2016

John,

You can always use NPS as an indication, but you cannot attach any statistical value on the results. More important are the verbatims > why would your respondents recommend/not recommend a certain sport.

John - June, 2016

But what if your team has 15 members, and you have a response from every single member?

Gert Van Dessel - June, 2016

John,

If you have a 100% response rate, you can use the NPS score for this group, as your margin of error is 0 in that case.

Richard - June, 2016

Hi,

The company I work for uses service tick and it is part of how we as employees are measured.

The company uses a 1-10 measure with 9-10 promoters, 7-8 Passive, 0-6 Detractors.

The Company has put down certain parameters:

50% of all customer interactions should be put through to the service tick survey.

Expected usage of word patterns such as:

“As I mentioned in the begining of the call, I will like to get some feedback on how you feel the call has gone today. You will asked to rate me between 1 – 10. 1-8 meaning I have not met your expectations today and 9-10 meaning we have covered what you wanted and I have met your expectations.

The first question in the survey “would you recommend us to friends” is a hypothetical question based on the service that I have provided, if someone were to ask you about our service, would you recommend me?”

My questions are as follows:

1) We are expected to “cherry pick” the positive clients. I.e. if you know they are not overly happy you do not put them through – hence the 50% measure of clients being put through.

If we are “cherry picking” what use is the survey if you are putting through only what you think is a promoter?

To get real value from the survey potential promoters and detractors should be put through to get a “real” score or feel?

2) The usage of the word patterns above? I think this word pattern tries to place words in the client’s mouth before they have even gone into the survey? What are your thoughts on this?

Many thanks

Richard

Gert Van Dessel - June, 2016

Hi Richard,

I completely agree with you. Any attempt to steer your answers in a certain direction (positive in this case) will undermine the value of your NPS measurement and bias the results.

The only correct way to use the NPS question is to ask the question ‘as such’ with the standardized formulation. Your selection of respondents should be random. If you want to sample 50% of your client base, you can interview your 1st, 3rd, 5th client etc.

Jennifer - March, 2016

Also, some of my NPS surveys come back blank – do you know why this is?

Jennifer - March, 2016

I would like to know – for the formula is it the total number of surveys divided by the total number of promoters (or detractors) – or is it only the total number of surveys received for the promoters and detractors divided by the total number of promoters (or detractors). For Example – I have 12 detractors, 3 passives, 15 promoters. would I only count 27 surveys for the NPS or would I count all 30? Would My NPS be 10 or 11?

Jennifer - March, 2016

NVM – I found my answer via google – But the second question is do I count the blank surveys and do you know why they come back blank?

Nadia De Vriendt - March, 2016

hi Jennifer,

Is it possible you didn’t mark the NPS question as required? I couldn’t immediately find an account under your name, so I can’t verify at the moment. If you provide the survey name or your account name to our support team, we’ll have a closer look.

Thank you!

Jared - March, 2016

Dear Gert,

Do you have any suggestions on good tag lines that could be used to ask for promoters……because I give you a 10! :0

Also have you found any successful ways to encourage the promoters to take the surveys vs just the negative ones? You are the best!

Gert Van Dessel - March, 2016

Hi Jared,

If you want a realistic NPS score for your company, this has to be based on a representative sample of your customer database. If you are trying to find ways to attract as many promotors as possible to fill in your NPS survey, you will not have a representative sample and your results will be biased. If you want to improve your NPS score, you do this by taking actions to improve your customer service. If you succeed in doing this, you automatically will have more promotors who will be glad to fill in you survey because they are so enthousiastic about your product/service. In a follow up question you can ask why they are so impressed with your company and you can post their comments on your website to attract new customers.

Lin - February, 2016

Is NPS software that you download or install on your site or are they just questions you ask during research?

Gert Van Dessel - February, 2016

Lin,

This is a question you ask in research, ideally followed by an open question to detect the reasons behind the given score. NPS is a standard question type in the CheckMarket survey tool, which has the advantage that you automatically see the calculated NPS score in your reporting.

Ron Hine - February, 2016

We perform surveys after every touch of our customers and NPS scoring is included. Our leadership team has recently been discussing moving to a Yes/Maybe/No answer scheme for the NPS question of would you recommend XX. There is concern that we receive an 8 at times from individuals that they believe are promoters. This has been validated in some of our follow ups to the lower score customers. Some managers feel the Yes/Maybe/No options removes ambiguity. What are your thoughts on this topic?

Gert Van Dessel - February, 2016

Hi Ron,

In my opinion your focus should be on improving your NPS score instead of questioning the methodology. Promotors are very enthousiastic customers who would spontaneously recommend you to other people. If there are not enough promotors for your company, you should think of actions you can take to increase your nr. of promotors (by moving them from passive to promotor) or decreasing your detractors (by moving them from detractor to passive). It is not your absolute NPS score that is most important, but the evolution of this score over time. Certain industries or regions tend to have higher scores than others, but it is not by changing your measuring scale that your companies performance or customer satisfaction will improve.

Charles - February, 2016

Hi Gert-

I really appreciate your diligence and effort to answer everyone’s questions.

I was curious if you could provide any insight on a question we have. We are conducting a survey where the first question is overall NPS, and the next two are “the pros to working here” and “the downsides to working here”. I have read that NPS should always have a “why” option following the question, however we feel that the answer to this question should be addressed in the pros and cons section.

Do you agree? Or do you still feel that we should include a why for NPS results along with the pros/cons.

Thanks, Gert!

Gert Van Dessel - February, 2016

Hi Charles,

I think those 2 questions will mostly cover the reasons behind the NPS score that has been given.

‘Why would you (not) recommend working here?’ will give you some more specific answers, the replies to your questions will go somewhat broader in my opinion.

DB - February, 2016

Gert-

Thank you so much for answering so many questions! I am going to add mine to the mix as well.

We want to include the NPS alongside our other questions in our survey. We are using 5 stars, however we allow the option for half stars as well. We would like to keep consistency with the format of the entire survey.

Here is my question: What do you think about using a 5 star rater with .5 increments for the answer to the NPS question? In our mind: 4.5/5 stars = promotor, 4-4.5 = passive, and 0-3.5 = detractor. Is this a sufficient way to capture the results goal of NPS, or do you see red flags?

Gert Van Dessel - February, 2016

Hi DB,

As long as you don’t want to compare with NPS scores from other companies and are purely interested in the evolution of your own scores, this would be an option.

But your scale only has 10 points, compared to 11 for the NPS. Especially the option to consider 3.5 as a detractor score, seems a bit odd to me. In my mindset a 3.5/5 is associated with a 7/10 score, which in the NPS framework is considered as a passive.

DB - February, 2016

My apologies, Gert. I meant to type 4.5-5 promotor, 3.5-4 passive, 0-3 detractor. If we include 0 as an option, wouldn’t that account for all eleven possibilities?

My last question – do you see any potential issues like the following example: The user rates 4/5 because they think that 4/5 is a good score (due to being used to rating 5 star sites), but technically by NPS measurements that is an 8 and considered passive? My thought is that we need to emphasize that 4.5 is an option, but do you think that that is enough?

Gert Van Dessel - February, 2016

That will be a better approximation of the NPS question. However, interpretation of the star rating can be different for a lot of respondents compared to the 0-10 scale. If you want to call it an NPS score, I would stick to the original 0-10 scale to avoid any criticism/discussions afterwards. I don’t see any advantage in using the star rating, besides that it might be more appealing to fill in.

DB - February, 2016

Hi Gert-

So are you saying that It would not be appropriate to conduct NPS with 0-5 and .5 increments? Or is it simply the star rating aspect that raises your concerns?

Gert Van Dessel - February, 2016

DB,

I am not saying you cannot use this scale, or that your results will be very different from the score obtained with the original NPS scale, but NPS is a standardised method; and if you want to compare with other NPS scores, I would personally stick to the uniform way of working as it was developed by Fred Reichheld and used by the large majority of researchers

Dave - February, 2016

Hi Gert,

Great stuff. Quick question – Can NPS be used to evaluate an individual? For example: “How likely are you to recommend John Smith to a friend?”

I am thinking in context of evaluating a boss/coach/teacher etc…

Thanks!

Gert Van Dessel - February, 2016

Hi Dave,

This is a possibility, but you must be sure to have enough responses to have a reliable score. It is also important to be clear about the context.

You could rephrase the question for example as follows: How likely are you to recommend John Smith to a friend as a teacher.

A person can be great as a friend or entertainer, but not necessarily as a teacher, and this is the skill you are interested in.

Of course, there are a lot of other questions that can be used in an evaluation process. In our tool you can check out a survey template with example questions for a 360° evaluation.

Dave - February, 2016

Thank you, this makes sense! What do you think about using NPS vs a simple approval rating? For example: do you approve of your teacher/coach/boss – yes/indifferent/no.

Gert Van Dessel - February, 2016

Dave,

According to me the NPS 0-10 point scale gives the the opportunity to add more nuance.

Someone who replies ‘yes’ to the approval rating question could have given a 7 score in the NPS question but also a 10. As you will agree, this implies a totally different evaluation of the person in question.

Dave - February, 2016

Thanks! Are there any issues with standard practice of having 2 NPS questions?

1. How likely are you to recommend organization to friend

2. How likely are you to recommend individual to a friend as a teacher

Gert Van Dessel - February, 2016

Hi Dave,

I don’t see any problem with that.

Babette - December, 2015

Hi Gert,

I have a question.

At the moment I am writing my thesis.

In my survey I also involved a question to get the Net Promoter score. The only thing is that I later on discovered (after getting al the results back) that I only included 1 through 10 and not the zero.

Can I still use the net promoter score in my thesis with these results. Or at least an indication of the outcome?

Many thanks in advance.

Gert Van Dessel - December, 2015

Babette,

I don’t think this will have an influence on the score you get (or a very minor one). A respondent that would have selected a zero score will not suddenly become a passive or promoter because that option is missing. I would however indicate in a footnote some explanation about this, because this is not the ‘official’ NPS scale.

Rob - November, 2015

Hi Gert,

I have a question about using NPS in an internal environment eg IT support inside a large corporate.

Plenty of people are keen on using NPS, but I feel the whole premise of asking “would you recommend our services to a friend or colleague?” is somewhat flawed given they dont really have any choice, ie there is no competing IT dept, nor do they pay for each service. So whilst we can compare to our own monthly numbers, comparing for example to Apple or Amazon’s published NPS seems invalid to me.

What do you think?

Thanks

Gert Van Dessel - November, 2015

Rob,

What you have to do in this case is look at the evolution of your own NPS over time. Try to use open questions to detect problems or flaws in your service, develop an action plan to handle these issues, and then look at the impact on your NPS. This is a continuous process and in the long term you should be able to see a significant improvement in your NPS score.

Rob - November, 2015

Perfect, thank you. Compare apples with apples… :)

Aamir Qadri - December, 2016

Our company sends out NPS survey to 7200 customers ever six months. Usually, ~1200 open the email— but only ~300 submit any response… with about half of those including a comment. Is ~25% of our customers opening NPS survey actually submitting answer similar to industry response rates?

Gert Van Dessel - December, 2016

Hi Aamir,

It is difficult to give an ‘average’ response rate for NPS research. This depends on a lot of factors, for instance:

– the bond the customer has with the product (e.g. response rate for a NPS survey about your holiday will probably generate higher response rates than for a survey coming from your insurance company)

– the timing of your survey (e.g. lower response rates during a holiday period)

– familiarness with the name of the sender

– the subject of your e-mail (keep it short, clear and inviting)

– the attractiveness of your e-mail invitation (embedding your NPS question in the e-mail will boost response rates!)

– the length of your survey (keep it short en to the point)

– …

So you will understand is very important to think carefully about all of these criteria and try to optimize the parametres you can influence.

Nikolay - October, 2015

Hello! I’ve got a question, maybe it’s a little bit offtopic, but still very close. We are making at our company (real estate sector) a regular monitoring of client’s opinion: asking them several questions, one of them looks very much like NPS. But we ask also to evaluate the work of our managers on a 10-point scale (0 or 1-worst, 10-best, as usual). At the end of month each manager gets an average point. We have noticed, that the average mark for almost every manager is about 9 points or higher. So it looks really like a very good job. But we have got some doubts now: is it really OK to have such a high “score” for a rather long period of time? Maybe we’re asking the wrong question? Or the people feel some kind of a compassion for the managers and therefore asess them high? Or it’s a feature of Russia’s mentality, to give a high grade?

Please share your opinion, if you have got any experince in the area. Maybe there were some researches on the topic…

Gert Van Dessel - November, 2015

Nikolay,

It is absolutely true that certain cultures tend to give higher scores than other ones, but it is very difficult to determine the regional impact.

It seems like the managers in this study are doing a very good job indeed if they only get 9’s and 10’s. NPS is not the ideal measure to measure manager’s performance, as it was developed as a customer satisfaction index. I would suggest to use a number of different statements about the managers conduct/performance using a 5-point Likert scale (‘totally disagree’ to ‘totally agree’). Or even better a 360° exercise. In our survey tool you can find a template for a 360° evaluation questionnaire. You can register for a free trial to check this out.

anna - October, 2015

Hi Gert,

Can you please send an example how could NPS be introduced as a part of performance evaluation.

Paul - August, 2015

Hi; i work in a telco company doing online survey through phone call (CATI) i would like to know what can we do with respondent who are detractors (5 and 6) but giving promoters reasons and seem to not be unhappy customers. Do we need to exclude those detractors by consider just a scale from 0 – 4 or need to keep them.

Gert Van Dessel - August, 2015

Hi Paul.

Thanks for your question. I would not start messing with the answer scales. When someone gives you a 5 of 6 score, you can not consider this as a happy customer, eventhough his comments are on the positive side (maybe this person is afraid to show any criticism by phone and only gives social desirable answers). The NPS is a standardized index, if you start adjusting scales your comparability with other sectors’ or companies’ NPS scores will be gone. And you have to remember it is not the absolute NPS value that is most important, but the evolution over time (the impact of the actions you undertake to increase NPS).

Kaf - May, 2015

Hi

We are just entering the wonderful world of NPS and initially have 5 different scores for individual depts.

The CEO is looking for one overall NPS score for the company. Reading your comments to date not sure if that makes sense. I had thought of adding the total number of Detractors, Passives and Promoters to obtain an overall score. Sample sizes are different for different depts which would skew this result. Any advice please on how to calculate or if indeed we should calculate one overall score

Gert Van Dessel - May, 2015

Hi Kaf,

Thanks for your question. It does make sense to calculate an overall NPS score for your company.

To do this you have 2 options: you can sum up all individual scores and use the normal NPS calculation (all promoters – all detractors). Or you can calculate separate scores per department and use an average of the department NPS scores. The last option is useful when the nr. of responses per department differ significantly, while each department is equally important.

When you want to attribute different levels of importance to the departments, you can use a weighted average of the departments NPS scores.

Kaf - May, 2015

Thanks Gert

Ferjo Fereja - May, 2015

How do I interpret NPS result say for example if the result is -25%,45% and 75%?

Thank you in advance.

Gert Van Dessel - May, 2015

Generally speaking I would say you have to strive for a positive NPS score. 75 can be considered as an extremely good score, 45 is also still very good, -25 is rather poor. But even more important is the evolution you can see in the score over time.

It is beter to go from NPS = 30 to 40 then when you have a situation where your NPS score drops from 50 to 40.

Ritesh - April, 2015

Hi Gert,

Why cant NPS be calculated on a scale of 1 to 5. 1,2,3 being detractors, 4 being passive and 5 being promoter. Is this calculation not accepted globally.

Gert Van Dessel - April, 2015

Ritesh,

NSP is a globally standardized index which uses a 0-10 measurement scale. If you want to benchmarks with other NPS scores (in other countries or sectors), you will have to use this scale. The 0-5 scale will be an approximation, but is not quite te same

Ritesh - April, 2015

Thanks Gert

Sara - April, 2015

We have been utilizing the NPS Survey in our company for the last 6 years. From the beginning it has been offered 100% via live agent O/B call without a mix of IVR or email responses. The responses are then documented by the agent, agent selects categorizations based on the topic mentioned as it aligns to whether it was a satisfaction driver or dissatisfaction driver, and then an NPS score is calculated for each process/operation mentioned to cause sat/dissat.

Now we are considering transitioning all or part of the NPS survey collection to Email method to save headcount and to increase response volume. My concern, before doing so, is whether this transition has been proven to 1) Add greater benefit by the elimination of agent subjectivity when categorizing, and 2) Is live phone agent discussion the best way to delve deeper into the root cause of the sat/dissat, and thus should be maintained if possible.

What delivery methods do the majority of top companies utilize when conducting NPS Surveys?

Thanks

Gert Van Dessel - April, 2015

Hello Sara,

Thanks for your question.

The benefit of phone interviews is that you can dig deeper in details and ask for explanation if anything is not clear. On the other hand, our own experience has learned that respondents tend to be more honest in online questionnaires, which results in lower NPS scores (difference of 10 or more index points). When talking to someone by phone respondents feel a certain barrier for expressing criticism (this is called satisficing effect). And as you point out, there is also some subjectivity when you have to depend on the agents to make the categorization. You can use both methods, but have to be careful with historical comparisons when you shift from one to another.

Barry Parr - April, 2015

Good suggestions. The simplicity of NPS is the key to its success, and also why you should consider it. It’s easy to overthink customer satisfaction. The NPS methodology makes that hard to do, so you can focus on your product and service and not your methodology.

The lack of benchmarks by industry is frustrating. It’s hard to get good data without paying a consultant.

We took the NPS methodology a step further, by linking our responses to customer behavior. We found out some interesting things about our customers, including that those customers who asked for the most help were some of our best customers.

Gert Van Dessel - April, 2015

Hi Barry,

Great article with some valuable insights. Benchmark data are hard to find indeed.

We also have the impression that people who frequently contact our support department are amongst our most happy customers (which can be considered as a compliment for our support colleagues…)

George - February, 2015

Can we use nps for departments as opposed to the e tire organization? I lead the service department at our organization and want to know specifically of the client would recommend the service department since we have another survey sent for the entire organization.

Nicolas - January, 2015

Hello, what are the fundamental differences between NPS and Customer Satisfaction Index (CSI) ?.

Thanks

Krish - January, 2015

Hi Nicolas,

First of all both NPS and CSI are measures of customer experience. NPS is a measure of advocacy which links to the survey question “who likely you are to recommend XXX on a scale of 0-10”

A CSI score is a measure of satisfaction which links to the survey question “how satisfied are you with XXX”

The argument for NPS is usually that it relates to the customer’s propensity to churn or increase product holdings. Whereas it a customer is satisfied with your product or service, it wouldn’t necessarily stop the customer from considering an alternative provider or encourage the customer to sign up for new products.

However, in my opinion, both have merits in their own right when used in the appropriate context. For example asking a customer whether they’d recommend you on the back of a non-defining moment or transaction (e.g.provided me my acct balance ) wouldn’t make sense.

On the other hands there are some aspects of your product or service that you’d expect the customers to always be satisfied with. If there are not it is likely to be a churn trigger. This is where CSAT might be more appropriate as a measure

Jackson - January, 2015

When presenting the question in a survey to a customer is it against the methodology to publish the likert scale? For example: Adding Color Coding. 1-6 in Red, 7-8 in Yellow, 9-10 in Green. So that customers know what is green, yellow or red?

Gert Van Dessel - January, 2015

Jackson,

We strongly recommend not to add color coding to the answer scale, as this will lead to bias in your NPS score. We have done some tests in the past, and we noticed that the NPS was considerably higher when using this color coding compared to the ‘standard’ NPS (about +10). People tend to give more scores in the ‘green’ area’. Which is of course great if you want to have a good NPS score for your company, but not really honest when comparing your score with the NPS of your competitors.

Anja - December, 2014

Hello,

we would like to start up a NPS research for our B2B partners (retailers, distributors, installers), but we are struggling with the way to ask the NPS question. For your information: We would ask the question to the person who places the orders (buyer).

We are considering several options: How likely are you to recommend to “????”

– if we put ‘other distributors’ , the reaction can be that they don’t want to recommend the brand because they don’t want that other distributors sell our brand

– if we put ‘others’, than they might think that we mean “endconsumers”. But we want a more general view, not only on product, pricing etc. but also on service provided by us as company.

– If we put ‘colleagues’ or ‘friends’, I’m afraid it will be too difficult to comprehend what we mean considering the target group (that they don’t understand why we are asking this)

We want to capture the total brand perception (so price, service, product, etc.). What is the best way to ask the question without confusing our partners?

Thanks for your help,

Anja

Gert Van Dessel - December, 2014

Hi Anja,

What do you think about ‘other colleagues in the sector’. I think that would cover it. If necessary you can add ‘(retailers, distributors, installers)’ between brackets.

So: “How likely are you to recommend [YOUR COMPANY] to other colleagues in the sector (retailers, distributors, installers)?”

Marina - December, 2014

Hello,

In my company we have been using NPS for some years now. I fully agree with your article, although it is very useful there are some critical points like not taking into account “passive” (answers from 7 to 8). Do you know if there is any study or article about cultural influence on NPS. I explain myself. In Europe, there are a big difference in giving a score (starting from school): in latine countries it is very difficult to give a 9 or a 10 (at school impossible) because it means perfection, and it is more usual to give a 6 or a 7 which does not mean you are not satisfied or passive. In northern Europe when you are satisfied it is normal to give 9 or 10. Therefore, comparing countries is difficult and scores are not as good in southern europe countries / latine countries. Is there any study on this?

Thanks a lot in advance!

Gert Van Dessel - December, 2014

Hi Marina,

The issue of cultural differences influencing NPS score has already lead to lots of discussion. One of our own articles talks about the need for an adjusted NPS-EU score for Europe:

https://www.checkmarket.com/2012/01/we-need-an-nps-eu/

Another interesting blog about the ‘Dutch’ effect on NPS:

http://customergauge.com/news/net-promoter-is-there-a-dutch-effect/

And a discussion on the NPS forum about the same subject: http://www.netpromoter.com/community/net-promoter-forum/alldiscussions/viewthread/?GroupId=25&MID=4267

What we learn from all this, is that there obviously are differences between regions, sector, etc., there’s not much we can do about this.

Our advice is not to worry too much about benchmarks. More important is the evolution of your own NPS score. Start tracking it over time, use key-driver analysis to find out which factors influence your score. Ask your respondents to explain their score to gain valuable insights. And try to improve your NPS period after period, setting up clear objectives.

Pery - October, 2014

Thanks for your efforts in this blog. Great info.

We’re in the process of implementing NPS to our internal customer base. Our current plan is to send the survey to 1/12th of our customer base each month, so each customer would have a chance to participate once per year. In the scenario, would you suggest that our NPS be reported as the “rolling average” vs. the current months results?

Gert Van Dessel - November, 2014

Hi Pery,

Thanks for the compliment.

Great idea to send out the survey to 1/12th of your customer base, this will avoiud survey fatigue.

I agree you can use the current months’ results and the 12m moving average for the reporting.

Current month fort the short term follow-up, and your 12m average contains the responses for all of your customers then.

Amber - October, 2014

I need to know the formula which shows how many positive surveys are required to achieve the NPS target of 62% you can use this data for an example : NPS: 48% , Detractors: 17.07%, Neutrals: 17.07%, Promoters : 65.85%. Number of surveys : 0-6

=7, 7 to 8= 7, 9 to 10= 27.

Gert Van Dessel - November, 2014

Hi Amber,

First of all sorry for my late reply…

I’ve taken a look into this, and here’s my calculation based on your example (promoters = P, passives = N, detractors = D).

NPS = 62% = (P-D)/(P+N+D)

> P-D = 0,62P + 0,62N + 0,62D

> P-0,62P = 0,62N + 0,62D + D

> 0,38P = 0,62N + 1,62D

> P = (0,62N + 1,62D)/0,38

For your example (D=7 and N=7) this means:

P = (0,62*7 + 1,62*7)/0,38 = 41

So with 7 detractors and 7 passives you will need 41 promoters to get a NPS of 62.

Mel - September, 2014

Hi Gert,

Great article and advice you have provided.

We have an NPS project where we get completely different scores across different countries. There is discussion about adjusting for cultural differences. i.e. Some people believe that the differences in scores is due to people in different countries respond differently to the 0-11 scale, rather than a real difference in their likelihood to recommend. I don’t think making adjustments is a good idea – are we really adjusting for cultural differences or are we compensating for poor CSat?

I would love to hear your opinion.

Joyce - September, 2014

Hi,

We have a business that has different Touch Points and customer responses would pertain to different departments from time to time as their negative experience had more impact than their current experience.

I have gotten requests to change touch points score because it is not their issue.

Currently we do not change scores as we believe issues no matter where t came from is a business issue.

Should we be changing scores and recalculating results if the issues does not belong to that touch point?

Looking forward to your clarification.

Gert Van Dessel - September, 2014

Hi Joyce, thanks for your question.

I understand your problem, but I would’t start manipulating scores, as this will open the door to randomness and criticism. There is no point in departments telling ‘we got a bad score, but is was not our fault’.

Although based on specific touchpoints experiences, your customer will have a global opinion about your company or service.

The real value of your survey lies in the open comments given by the respondents explaining the NPS score and reason for their satisfaction/dissatisfaction.

Based on this you can take appropriate actions targeted towards the different Touch Points.

Joyce - September, 2014

Hi Gert,

Thank you so much. We have started educating each touch point to focus on improving what they can control based on customer feedbacks and hope to see better customer experience.

Have a great day!

Gert Van Dessel - September, 2014

You’re welcome Joyce. Good luck with your NPS journey!

Jessica - September, 2014

Hi Gert,

Great article. I have two questions for you.

#1 Would you recommend sending out an NPS with simply two questions: (1. how likely is it that you would recommend… and 2. to help us continue to improve our product, please explain why) or is it best to include more?

#2 How many respondents is needed to get a true representation of NPS? We have a number of different products, each with a separate post purchase NPS survey sent 1 day following purchase. We collect and download results monthly. Some have as few as 40 and some as high as 1000 respondents in a month. We have very low (-) results and want to find out how best to improve our score.

Thank you.

Gert Van Dessel - September, 2014

Hi Jessica, thanks for the compliment.

It is certainly a possibility to only use 2 questions (NPS + follow up question) in your NPS survey, especially when you have difficulties collecting enough responses (the shorter the survey the higher your response rate.

You could however differentiate in your formulation of the follow-up question for promotors, detractors and passives. E.g. the formulation for promoters could be ‘Great to hear you give us such a good score! What can we do to even further increase your satisfaction?’ and for detractors ‘Sorry to hear you only give us a 4 out of 10. Why are you disappointed in our product and what improvements can we make?’

In our survey tool you can use branching to show the relevant question based on the NPS score and you can use ‘piping’ to include the given score in the follow-up question. Another option would be to send alerts (e.g. a mail to the account manager) for each detractor respondent so he/she can be contacted (for more information see our article about the 4 stages of NPS: https://www.checkmarket.com/2014/06/4-stages-of-net-promoter-score/

For the sample size we recommend a minimum of 100 respondents for each product or service you want to measure. Of course when you are dealing with a group that isn’t very large (e.g only 50 key customers) you can still get reasonable feedback if 70-80% of them answer the survey.

Stephen - August, 2014

Do you think it would be fair to link an advisors NPS to a bonus. I think NPS is a fantastic tool for a company to measure success of both the agents and the customer service they offer but do you feel that someones personal interpretation on a limited number of NPS feedbacks linked to a bonus could be seen as unfair? Your views would be appreciated.

Gert Van Dessel - September, 2014

Hi Stephen,

Sorry for the late reply due to to holiday. I do know of some (large) companies using NPS as a parameter for bonus calculation. However I do agree that the number of respondents you use to calculate the score has to be large enough in order to be statistically significant. I would go for at least 100 respondents for each reviewee.

Aneet - August, 2014

apologies .. pls read that as Gert,

Aneet - August, 2014

Hi Greta,

Why is 0-10 scale used for NPS ? why not a 1-10 ?

Many Thanks

Gert Van Dessel - September, 2014

Hi Aneet,

That’s a question you will have to ask Satmetrix, the original developer of NPS. The 0-10 scale is is the widely spread standard that is used in all regions and industries. A reason could be that the 0-10 scale has a ‘neutral’ midpoint 5 (with 5 better and 5 worse scores) but that’s pure speculation from my side.

saurabh - August, 2014

if we are using 0-5 scale

what will be detractor/passive range

Gert Van Dessel - August, 2014

If you wnat to calculate a NPS score you will have to use the 0-10 answer scale, otherwise it’s no NPS index.

Also for benchmarking purposes I recomment to stick to the 0-10 scale.

If for some reason you are obliged to use the 0-5 scale, I would go for 5 = promoter, 3-4 = passive and 0-2 = detractor. But don’t call it an NPS index then.

Zacharia Burton - August, 2014

Hi Gert,

What would you say should be the NPS target for a disconnections department in the telecommunications sector?

Gert Van Dessel - August, 2014

Zacharia,

I cannot help you with specific target scores, as this is very specific per sector and region. It is best to start with your own zero measurement, and based on that set a target for the next measurement period.

Christian - July, 2014

Hi Gert, Thank you for the blog and all your effort responding to questions. My company is considering implementing NPS, but our contact center mainly supports our indirect sales channels; namely partner and OEMs. Therefore, I think the “would recommend” question would be a bit awkward as our partners friends and family would simply never use our services. Do you have any experience in such an indirect B2B environment? Would a simple rephrasing of the questions such as “How satisfied were you with our services” have the same interpretative effect?

Thanks again!

Christian

Gert Van Dessel - July, 2014

Hi Christian,

The ‘would recommend’ part is inherent to the NPS questions, if you leave that out you won’t be measuring NPS anymore. When you recommmend a service to some of your a acquaintances you put your own reputation at risk, which goes a step further than simple satisfaction. Maybe you can replace friends/family by ‘other manufacturers/potential partners?

Mpho - July, 2014

Awesome article Gert, our company is introducing NPS in our department stores but we are grappling with the best way to distribute the survey to customers. We have printed cards with the NPS question, a scoring from 0 to ten and fields for additional comments. We want to conduct transactional NPS but the main challenge is where to hand the customer the card during their shopping journey; at the door, while they are shopping, at the till point etc. Please advise

Gert Van Dessel - July, 2014

Hi Mpho,

As you want to measure the shopping experience as a whole, I would hand out the NPS cards when your customers have finished their shopping journey, which means at the till point after they have paid.

When you give them the cards before or during the shopping, this could create some bias, as your customers are aware they have to make an evaluation and may become more critical are more aware of details they wouldn’t notice otherwise.

Alanna - June, 2014

Hi Gert,

My company has recently started using NPS, however the scale is from 1-10, not 0-10. The question is also optional, so if a customer does not fill in the score, then it counts as a zero in our system, which we are then excluding from the sample size. I just have a couple of questions I was hoping you could help me with:

(a) What is the impact of only using a 10 point scale instead of the 11 point scale?

(b) Should we be including the zero scores (non respondents) as detractors?

Thanks

Gert Van Dessel - June, 2014

Hello Alanna,

If you have just started measuring NPS a couple of weeks ago, I would consider changing the scale to 0-10. The impact will probably be marginal, but it is better to start on a correct base, especially when you want to benchmark with other NPS scores.

The non-respondents cannot automatically be considered as detractors, so don’t include them in your calculations.

Sandra - June, 2014

HI Gert,

Quick question: where would you recommend to position the NPS question in a surveys (when the survey is made of several questions, out of which the NPS one): as the first question or rather at the end of the surveys?

Gert Van Dessel - June, 2014

Hi Sandra,

Both options have pro’s and con’s.

If you ask the question at the beginning of the survey, you will get a higher number of people responding to that question, but only a “top of mind” answer. If you ask at the end, you may get fewer responses, but the responses you do get will be more thought out after the respondent gets more context as they answer all the other survey questions.

If the questionnaire is not too long and you are confident that you will get enough fully completed surveys, I would put it at the end (followed by an open question to explain the score).

Parth Kochhar - May, 2014

Which other tools can be used for measuring cutomer satisfaction?

Gert Van Dessel - May, 2014

Parth,

The internet is full of interesting customer satisfaction measurement techniques and tools. One concept that is showing up a lot lately is the co-called Customer Effort Score (often in comparison with NPS).

This score is based on the question:

“How much effort did you personally have to put forth to [insert interaction here, e.g., get this issue resolved]?”

The 5-point answer scale goes from ‘Far less than I expected’ to ‘Far more than I expected’

An introduction to the topic can be found in following article:

http://www.cx-journey.com/2012/06/whats-your-customer-effort-score.html

However the NPS remain, in my opinion, one of the most useful, intuitive and easy to interpret customer satisfaction indexes.

Parth Kochhar - May, 2014

Which other tools can be used to measure customer satisfaction ?

Efthymios - May, 2014

Can we use the NPS for measuring the performance or the inluence of the job of an employee/executive e.g. ask customers to evaluate the question: “Do you think that the support u get from John is satisfactory?” from 0-10?? Would that be right??

Gert Van Dessel - May, 2014

Efthymios,

You can use NPS for this, but then you would have to reformulate your question as follows:

How likely are you to recomment ‘John’ as a support contact person to your friends or family.

If you use this formulation, you can perfectly calculate the NPS score

Tom Vivian - April, 2014

I am looking for information on how many surveys we need to do in order to achieve a statistically accurate sample in NPS surveys. I find this answer easy to come by on typical CSI surveys (where customers are divided into only two groups), but much harder on NPS surveys where customers are divided into three groups. I am looking for results with no less than this level of accuracy: 3% margin of error with 95% confidence rate in the results. We use NPS to track our customer ratings for our own company which is large and serves millions of customers. However, my job in vendor management is to track much smaller vendors, that may service as few as 100 or as many as 1000 customers per year. I am trying to figure out how many customers I need to have surveyed in order to achieve the kind of statistical accuracy I am looking for. Any ideas for a simple way to calculate what I need?

Didier Dierckx - May, 2014

Hi Tom,

That is a very interesting question.

As you know, in more traditional market research, the conventional minimum is approximately 300 respondents per segment.

However, the NPS score is based on proportions. As a result your MoE will be dependent on the distribution between the promoters/passives/detractors. For instance, a situation in which the majority of respondents is a promoter, the margin of error will be lower than when the distribution is more evenly spread. That is why I would not be aiming for a fixed amount of respondents for each segment (i.e. promoter, passive, detractor).

You can always calculate the MoE afterwards using the formula’s below:

VAR NPS = [(1-NPS)² x proportion promoters] + [(0-NPS)² x proportion passives] + [(-1-NPS)² x proportion detractors]

MoE = (VAR NPS/√n)

I hope this helps.

Didier

V Broman - April, 2014

When a caller is answering the NPS question(s) through the phone (IVR), the 11 point scale can be a bit tricky if the caller input a 1-0 slowly. It can be taken as a detractor (1) rather than as a promoter (10). To ask if the caller meant to enter a 1 rather than a 10 could be considered leading the caller. If the options were reduced to a 0-9 score, what impact would that have on the overall NPS scoring?

Gert Van Dessel - April, 2014

I would try to focus on solving the technical telephone problem. If you use the 0-9 scale, you won’t be able to benchmark your NPS results with other NPS scores.

Your NPS will probably be higher compared to the ‘standard’ NPS if you use 8-9 for promoters and 0-5 for detractors (people are intuitively more likely to give a 8-9 score than a 9-10 score). The only comparison you can make with this adapted NPS is with your own historical data.

Itumeleng Maimela - April, 2014

How do you calculate an acceptable sample for your customer feedback CSat: ( if your call center answered 1239682 calls and per agent 830 calls answered however the overal Rating from customer is 2923 and Csat is 91.71%. Is this a true reflection of our customers satisfaction? what would be the acceptable sample as per industry?

Anna - March, 2014

How often per year should you send out a NPS survey?

And once you get the results, should you focus on the passives or the detractors?

Gert Van Dessel - March, 2014

Anna,

If your client base is big enough, the best option would be continuous tracking, a lot of our clients do this. You can ask the NPS question after certain types of interaction, e.g. when a customer orders one of your products. This way you can immediately follow up dissatisfied clients. With the notifications function in our survey tool you can trigger automatic follow up actions (e.g. send an e-mail to the responsible account manager). In this way you can take action to convert your distractors into passives.

However you shouldn’t neglect the other two groups neither. Try turning your passives into promoters and keep your current promoters happy to avoid them dropping back to the passives group.

Gemma - April, 2014

Hello,

We want to continually track our NPS and ask at various parts of the customer journey.

I am confused by a couple of things : –

1. Can I generate a NPS for different parts of the business? ie one for client support, one for production etc. Then do one for the company as a whole?

2. Is it running data? So if I report back on a monthly basis, if someone gave us a 2 in February is that still counted in the results in September? Does that make sense? Or do I start from a clean slate?

Thanks

Gert Van Dessel - April, 2014

Gemma,

For Q1:

If your respondent base is large enough you can calculate NPS for different parts of your business. It’s best to focus on the evolution of the separate NPS scores per department or service rather than to compare them. E.g. your customer complaints department will probably get lower NPS scores because they have to deal with unsatisfied customers, but it(s the evolution that counts.

For Q2:

Again if your respondent base is large enough you can track month by month for the short term follow-up, and on long term you can use year by year NPS scores

Frits - January, 2014

What to do with rounding NPS in graphs?

We are calculating an NPS and had the following results:

Promoters: 83 (which is 58,45 %)

Passives: 12 (which is 8,45%)

Detractors: 47 (which is 33,08%)

We show these results in a graph that runs up to 100% and shows figures without comma’s. This means the graph shows:

Promotors: 59%

Passives: 8%

Detractors: 33%

The graph would than show a positive NPS of 25, but calculated on the original results it would present a NPS of 26.

To calculate the NPS are the actual percentages used or do you use the percentages which are presented after rounding on a 100% scale?

Olie - January, 2014